Financial Advisor Lifecycle Research

Unlocking Growth Opportunities Through Strategic UX Research

Note: Due to confidentiality agreements, full project details are available upon request.

-

LPL Financial is a leader in the retail financial advice market and one of the largest independent broker/dealer for independent financial advisors and financial institutions., providing them with the technology, research, clearing and compliance services, and practice management programs they need to create and grow thriving practices.

-

At LPL Financial, I worked as the sole design researcher (AVP Strategy) for the Strategy and New Ventures (SNV) team and later, as part of the Corporate Strategy team. The SNV team acted as an in-house incubator responsible for identifying new opportunities, rapid prototyping and testing potential solutions backed by design research and handing off successful solutions for formal execution and development to other product specialists in the company. As a design researcher, I got to lead several research initiative for projects, working closely with developers, strategists, product managers and financial strategists.

Overview

I led a comprehensive research initiative to map the complete career lifecycle of financial advisors, identifying strategic growth opportunities that directly informed LPL Financial's corporate strategy for the following year. This research bridged the gap between advisor needs and business objectives, resulting in actionable insights that drove product development and strategic decision-making at the executive level.

Research Goals

Map the complete career lifecycle of financial advisors from career exploration through retirement

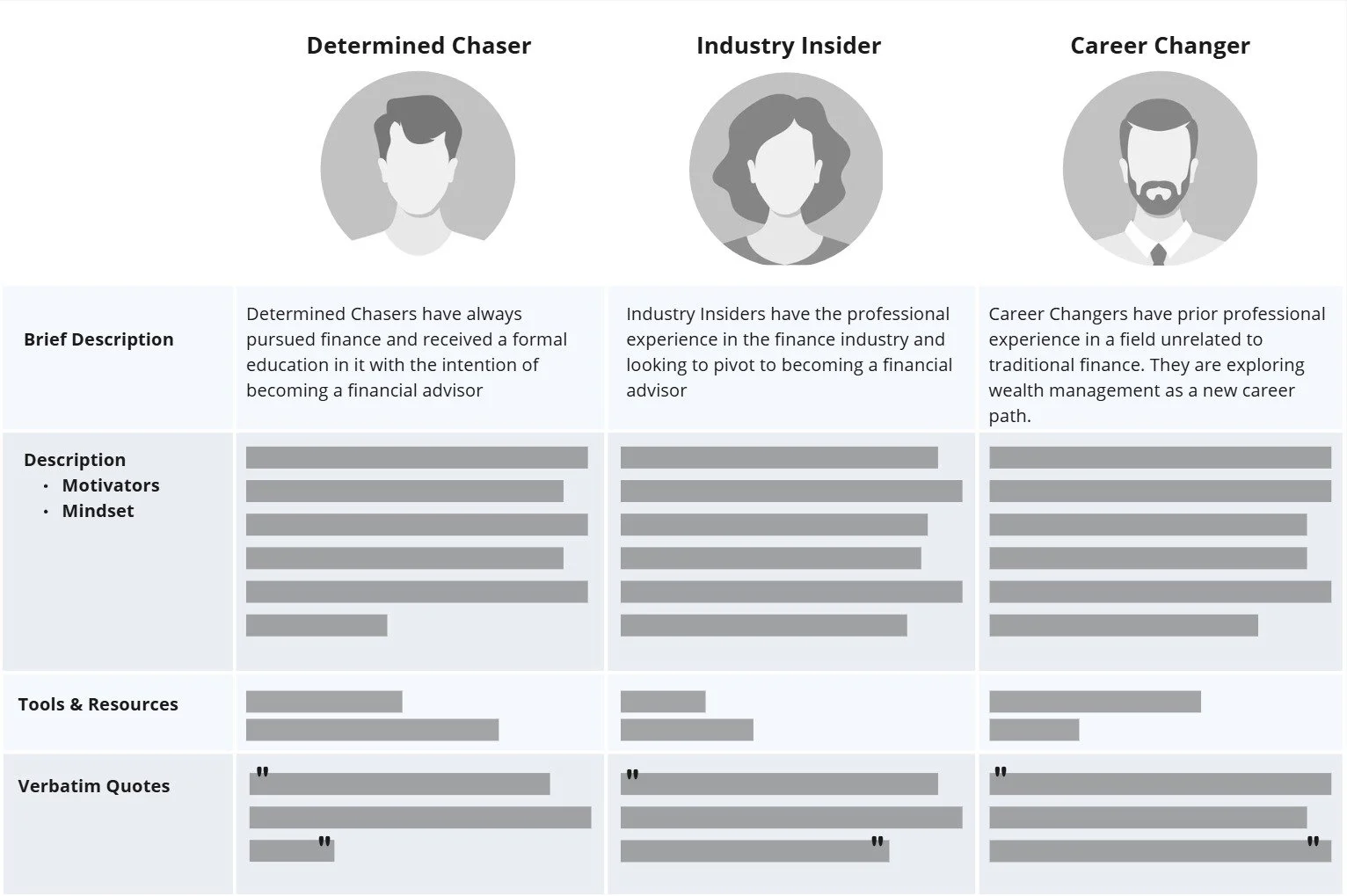

Develop comprehensive advisor profiles including motivations, goals, challenges, and demographic segments

Identify strategic opportunities to enhance revenue growth, improve retention, and develop new service offerings.

My Role

Lead UX Researcher (1 of 1)

Responsibilities

End-to-End UX Research & Strategy

Collaborators

Product Owners, Data Analysts, Strategists, Executive Leadership

Duration

3 Months

The Challenge

Business Objectives

Improve advisor retention rates and reduce churn in a competitive market

Identify new revenue streams aligned with advisor lifecycle needs

Evaluate existing services to ensure they address core advisor requirements across all career stages

User Needs

Ensure all advisors feel valued and supported regardless of practice size or AUM, particularly smaller solo practices who felt overlooked amid LPL’s rapid growth

Being provided with tailored support that evolves with career progression

Research Approach Preview

Stage 1 Discover: Understanding Our Advisors

Part A: Advisor Profiling & Segmentation

Goal: Understand the advisor ecosystem - identifying who our advisors are, their personal motivation, support systems, and core challenges to develop comprehensive user profiles for strategic service design

Method: 8 discovery interviews with LPL Advisors, analysis of prior survey results and desktop research

Part B: Career Lifecycle Visualization

Goal: Map the comprehensive lifecycle of financial advisors - identifying distinct career pathways, key milestones, stage-specific challenges, and evolving motivators to create strategic frameworks for lifecycle based service delivery.

Method: Collaborative design sessions, advisor feedback loops and iterative refinement (2 rounds of virtual calls with 14 advisors in total)

Stage 2 Exploration: Opportunity Identification

Goal: Analyze the advisor career lifecycle to identify strategic service gaps and high impact opportunities within LPL’s scope and feasibility - evaluating, prioritizing, and presenting recommendations to executive leadership and board of directors to shape corporate strategic direction for the following fiscal year.

Method: Data triangulation, gap analysis, ideation workshops - working with product owners, data analysts and strategists

Impact

Executive-Level Influence

Corporate Strategy Development: Research findings directly informed LPL Financial's company-wide strategic priorities and resource allocation for the following fiscal year

Board Presentation: Collaborated with strategic leadership to present insights and recommendations to the board of directors, securing executive buy-in for advisor-centric initiatives

Product Roadmap Integration: Generated multiple new product development streams aligned with identified advisor lifecycle needs

Revenue & Growth Projections

Specialized Service Offerings: Tiered service packages expected to increase average revenue per advisor through premium specialized offerings and improved retention of high-value practices

Training & Mentorship Programs: Projected to accelerate new advisor onboarding, reducing time-to-productivity and increasing long-term advisor lifetime value

Succession Planning Services: Anticipated to unlock revenue from aging advisor practices while facilitating smooth business transitions and client retention

Advisor Retention & Acquisition Metrics

Retention Enhancement: Research-informed strategies target improved advisor satisfaction across all practice sizes, with particular focus on previously underserved smaller practices

New Advisor Pipeline: Training programs and career pathway clarity expected to increase industry talent acquisition and reduce competitive recruitment challenges

Loyalty Strengthening: Early lifecycle engagement strategy projected to build deeper advisor relationships and reduce platform switching